AML Risk Finder

AML Risk Finder

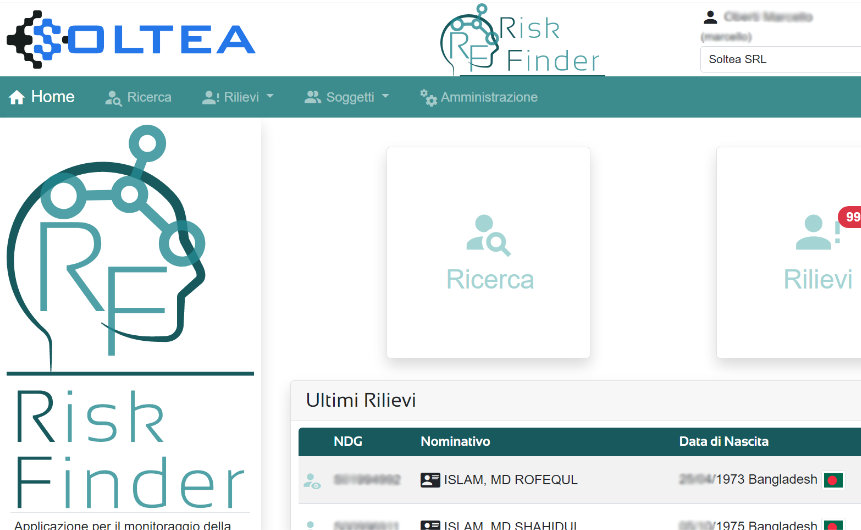

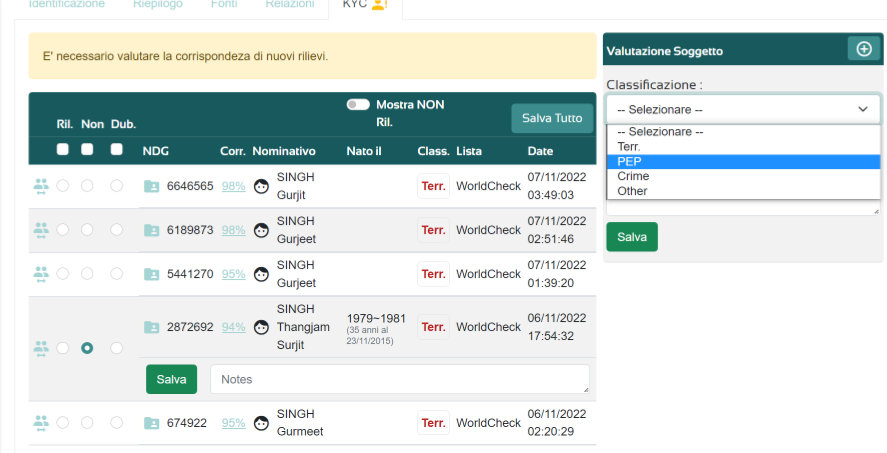

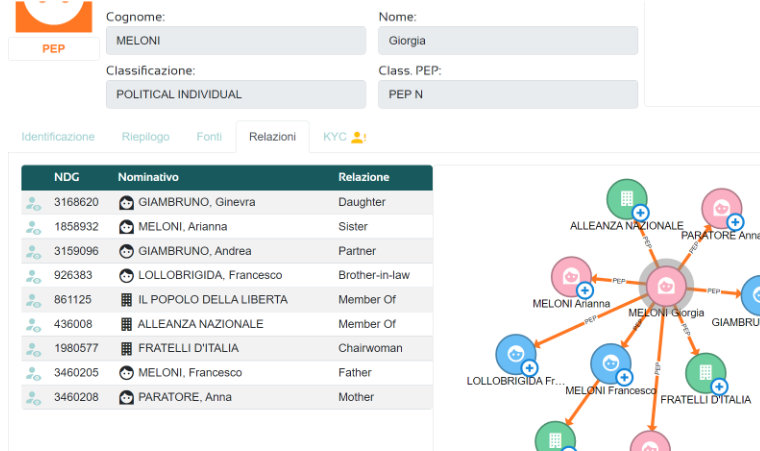

Name Screening

Software solution for name screening (customers, suppliers, employees) on WatchList. Real-time monitoring against any list: PEP, Sanction Lists, Adverse Media…

A complete suite of features to efficiently and accurately manage your AML and KYC (Know Your Customer) processes.

Available in multiple configurations both On-Premise and in the Cloud.

AML Risk Finder

AML Risk Finder

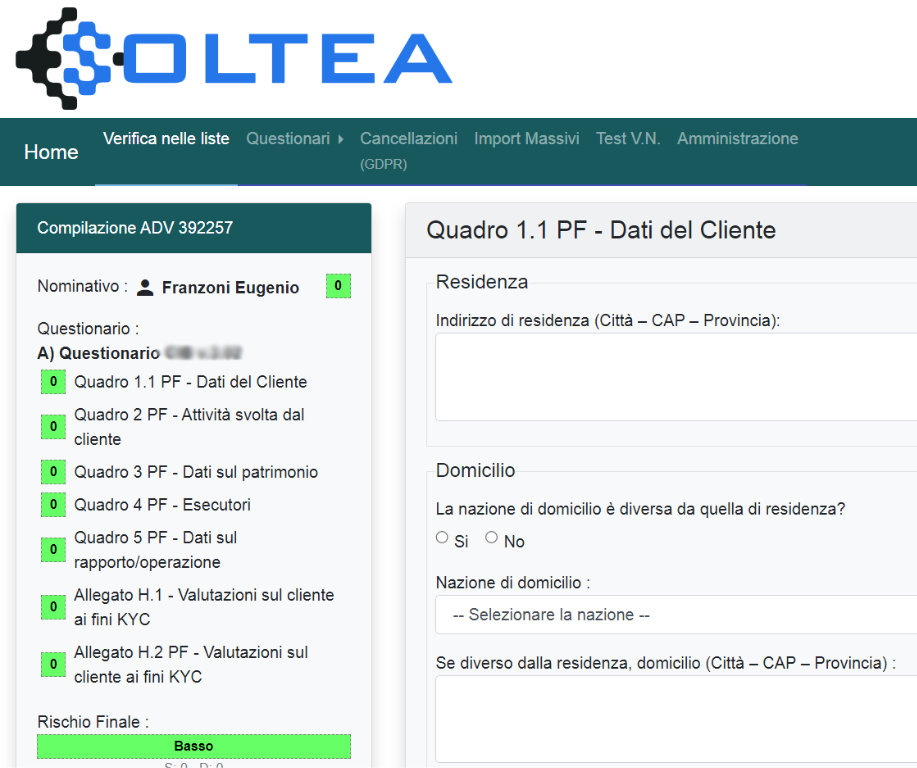

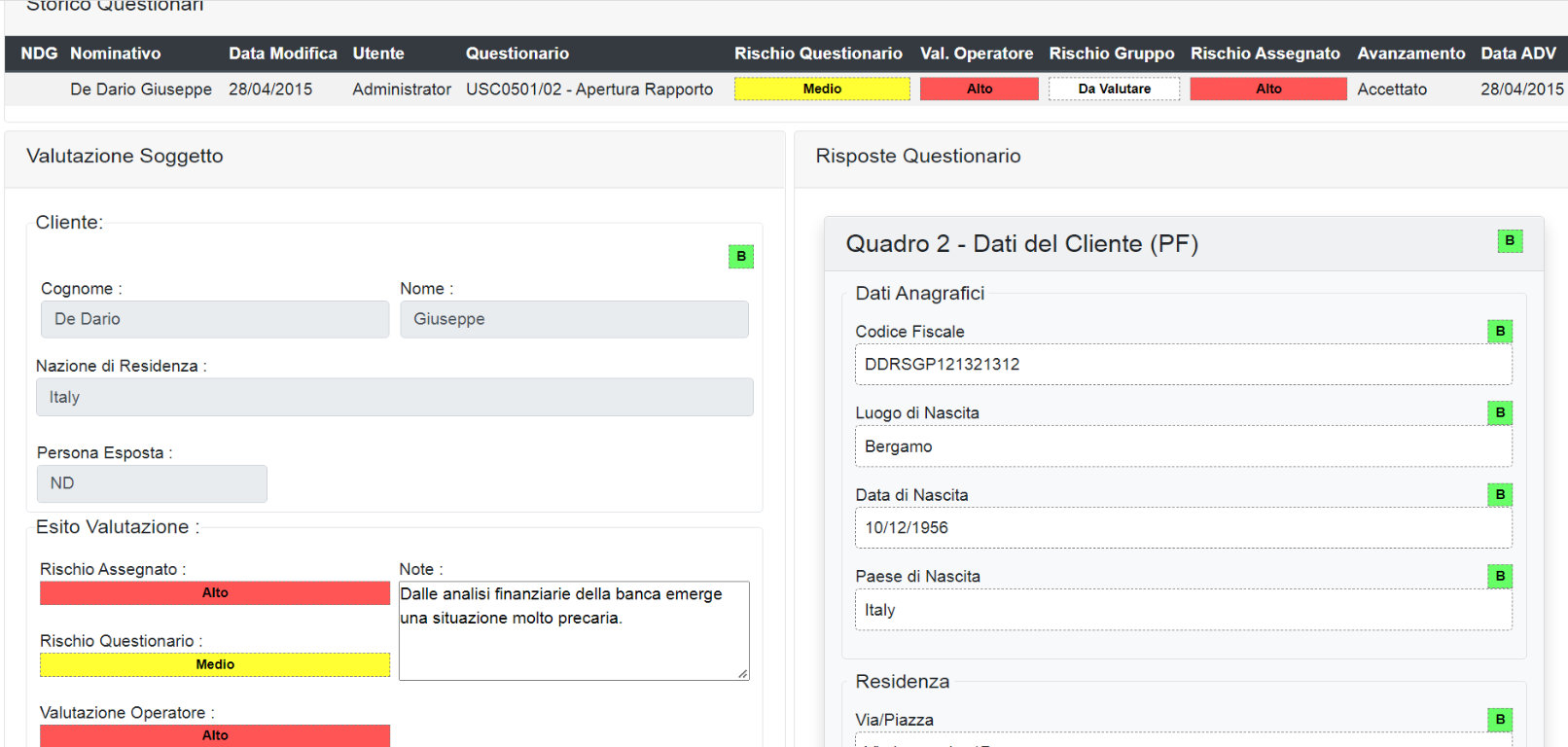

DD Profiler

Software solution for Due Diligence questionnaires management.

Fill free to configure questions, answers and scoring as your risk evaluation model.

Dataentry Automation and Risk Evaluation.

Integrated with AI tools for automatic data import from paper and PDF questionnaires.

AML Risk Finder

AML Risk Finder

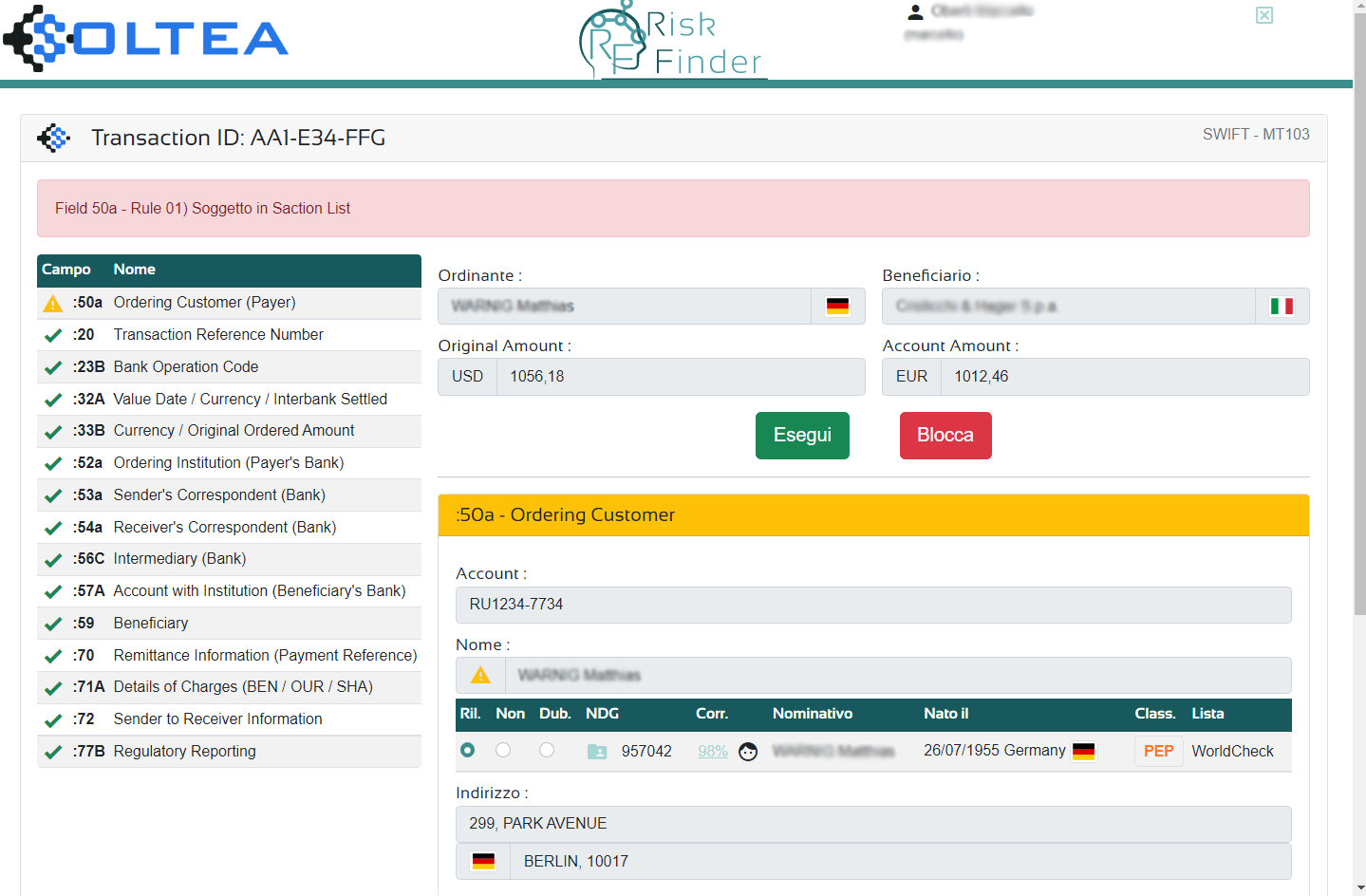

Transaction Screening

Solution for transaction verification with real-time checks on all involved parties.

Set up all the rules you want, based on any field present in transactions; integrate whitelists, blacklists, and sanction countries.

Interfacing with any protocol (SWIFT, SEPA...) and scalable for high daily volumes (500,000+ transactions/day).